9 Easy Facts About Pkf Advisory Services Described

Table of ContentsThe Of Pkf Advisory ServicesThe Main Principles Of Pkf Advisory Services See This Report on Pkf Advisory ServicesThe Facts About Pkf Advisory Services Revealed9 Simple Techniques For Pkf Advisory Services

The majority of people these days become aware that they can not rely on the state for greater than the outright fundamentals. Preparation for retirement is a complicated business, and there are numerous various options offered. An economic adviser will certainly not just help look through the lots of rules and product alternatives and help construct a profile to maximise your long-term prospects.

Buying a residence is among the most expensive choices we make and the huge majority people require a mortgage. A financial advisor can conserve you thousands, particularly sometimes such as this. Not just can they look for the most effective rates, they can assist you analyze sensible levels of borrowing, maximize your deposit, and may likewise discover loan providers that would certainly or else not be readily available to you.

A Biased View of Pkf Advisory Services

A monetary adviser knows how items operate in various markets and will identify possible downsides for you along with the prospective benefits, so that you can after that make an informed choice regarding where to invest. As soon as your threat and investment assessments are full, the following step is to take a look at tax; even one of the most fundamental summary of your placement might help.

For extra challenging arrangements, it can indicate moving assets to your partner or kids to increase their personal allocations instead - PKF Advisory Services. A financial consultant will constantly have your tax obligation position in mind when making referrals and point you in the ideal direction also in complex situations. Also when your financial investments have actually been placed in location and are going to strategy, they must be checked in instance market growths or uncommon occasions press them off program

They can evaluate their efficiency versus their peers, make sure that your asset appropriation does not come to be altered as markets fluctuate and help you combine gains as the deadlines for your ultimate objectives relocate closer. Money is a complicated subject and there is whole lots to consider to shield it and make the most of it.

Indicators on Pkf Advisory Services You Should Know

Using an excellent financial adviser can puncture the buzz to guide you in the best instructions. Whether you need general, functional advice or a specialist with devoted proficiency, you might discover that in the long term the cash you spend in skilled recommendations will certainly be repaid lot of times over.

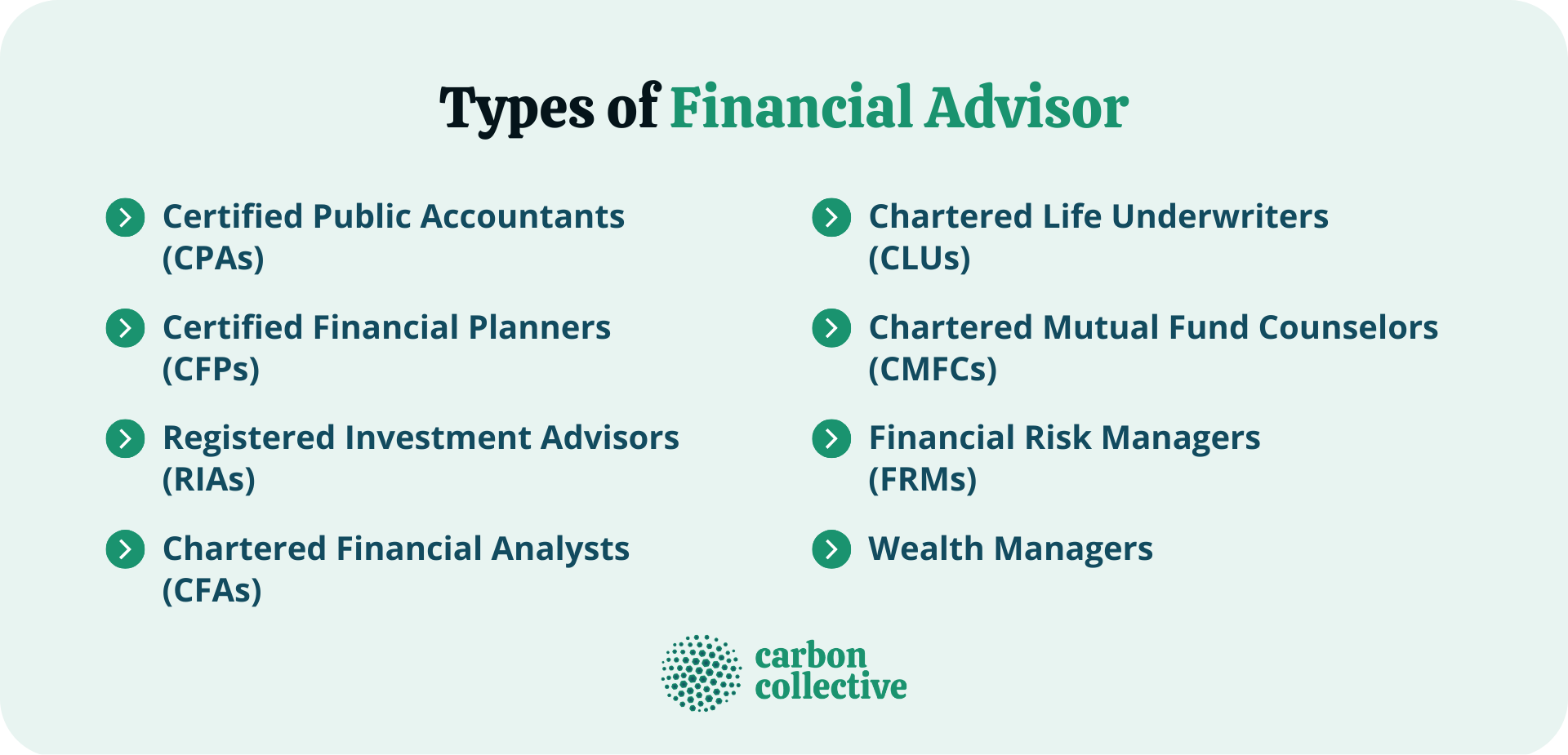

Keeping these licenses and certifications needs continual education, which can be expensive and lengthy. Financial advisors need to stay upgraded with the newest industry fads, laws, and ideal practices to serve their customers properly. In spite of these difficulties, being a certified and licensed monetary consultant provides immense benefits, consisting of many occupation possibilities and higher making potential.

Things about Pkf Advisory Services

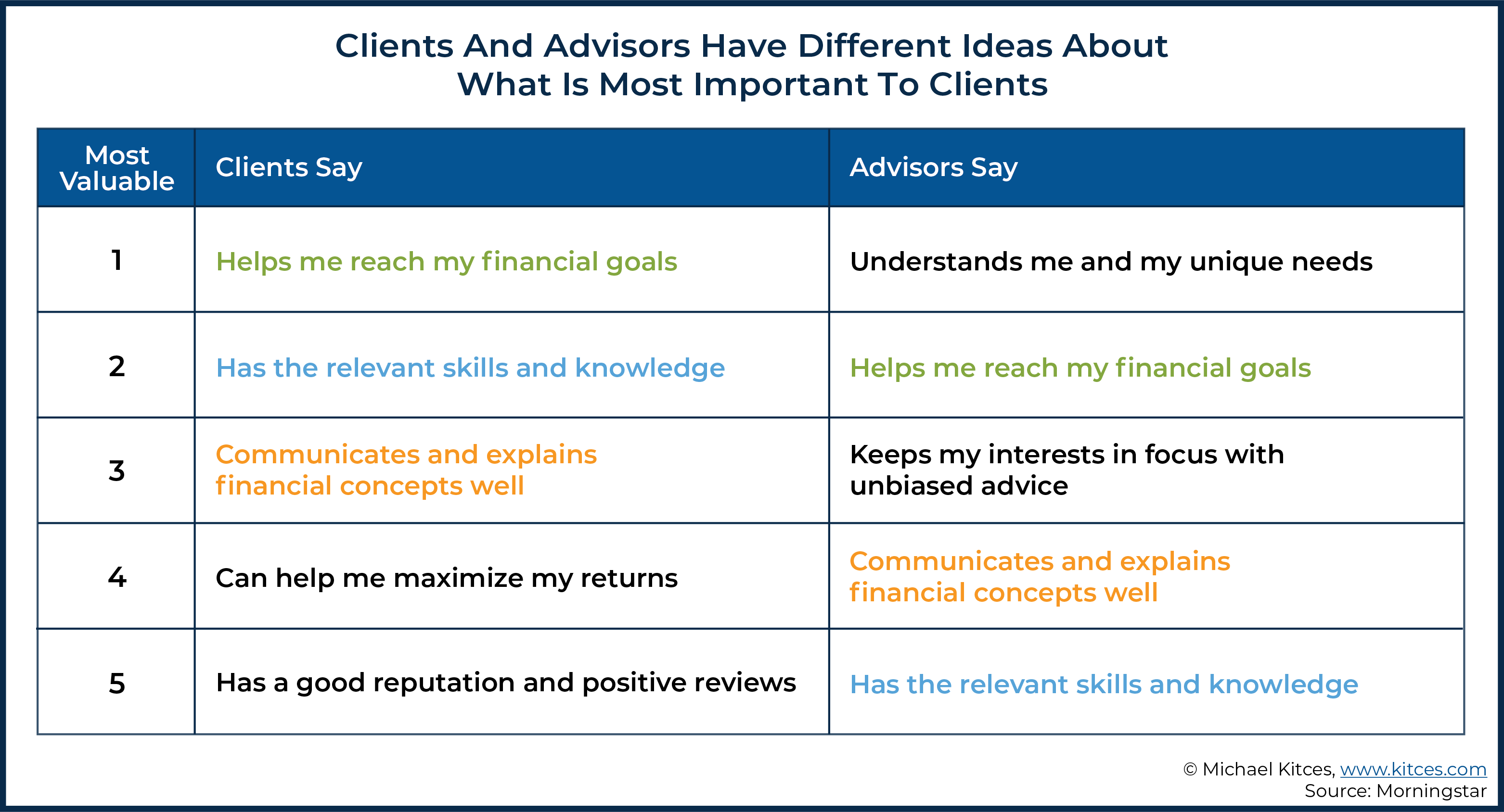

Empathy, logical skills, behavioral money, and exceptional interaction are extremely important. Financial consultants function carefully with customers from diverse histories, helping them browse complex monetary choices. The ability to pay attention, understand their special needs, and supply customized recommendations makes all the distinction. Interestingly, prior experience in money isn't always a requirement for success in this area.

I started my profession in company finance, moving and up throughout the company finance structure to develop skills that prepared me for the function I remain in today. My selection to relocate from company finance to personal finance was driven by personal needs in addition to the wish to assist the several people, families, and small companies I currently serve! Attaining a healthy work-life balance can be testing in the very early years of a financial expert's profession.

The monetary advising occupation has a positive expectation. It is expected to grow and evolve continuously. The job market for personal monetary advisors is predicted to grow by 17% from 2023 to 2033, showing solid need for these services. This growth is driven by factors such as an aging populace calling for retirement planning and enhanced understanding of the go to this web-site significance of more information monetary preparation.

Financial experts have the one-of-a-kind capability to make a considerable effect on their clients' lives, assisting them achieve their economic objectives and secure their futures. If you're enthusiastic regarding finance and aiding others, this profession path could be the perfect suitable for you - PKF Advisory Services. To find out more details concerning ending up being a financial advisor, download our extensive FAQ sheet

The 6-Minute Rule for Pkf Advisory Services

If you would certainly like financial investment recommendations concerning your details facts and scenarios, please speak to a certified economic expert. Any kind of financial investment includes some level of danger, and various kinds of investments entail differing levels of danger, including loss of principal.

Previous performance of any safety and security, indices, method or allowance may not be a measure of future outcomes. The historical and current details regarding policies, legislations, guidelines or advantages consisted of in this paper is a summary of details acquired from or prepared by other resources. It has actually not been separately verified, but was acquired from site link resources believed to be dependable.

A monetary advisor's most important property is not knowledge, experience, or also the ability to produce returns for customers - PKF Advisory Services. Financial professionals across the country we talked to concurred that count on is the crucial to constructing lasting, efficient connections with customers.